How To Melt Gold At Room Temperature

How to melt gold at room temperature

When the tension rises, unexpected things can happen – not least when it comes to gold atoms. Researchers from, among others, Chalmers University of Technology, Sweden, have now managed, for the first time, to make the surface of a gold object melt at room temperature.

Ludvig de Knoop, from Chalmers’ Department of Physics, placed a small piece of gold in an electron microscope. Observing it at the highest level of magnification and increasing the electric field step-by-step to extremely high levels, he was interested to see how it influenced the gold atoms.

Keep reading

More Posts from Techinfinity and Others

today’s robot of the day is: SpotMini by Boston Dynamics!

From transportation solutions to applications like video-streaming, Artificial Intelligence (AI) has impacted almost every aspect of our lives. It includes the government sector as well, which is in constant search of innovative technologies to make the lifestyle of the public more convenient. Taking the example of Emma chatbots, US Citizenship and Immigration Services receive loads of service requests on a daily basis.

The chatbot named Emma is specifically deployed to address the immigration questions. The chatbots possess the ability to operate in both English and Spanish languages and handle more than a billion immigration queries every month.

The adoption of AI has been steadier in the government sector as compared to the private sector. Though the magnitude of AI's impact is significant on public entities, it is vital to understand the roadblocks that are in the way of the government to adopt systematic AI.

There are major five key hurdles to AI adoption in government.

I survived by telling myself ‘I’ll kill myself tomorrow but not today.’ I kept putting it off for days and days and days with the hope that the darkness will leave my body one of these days. and some days, it leaves and some days, it stays. I’m still surviving and that’s the sad truth and maybe I’ll kill myself tomorrow but not today.

Juansen Dizon, Magic Mantra (via juansendizon)

What Future Holds For Digital Marketing

Digital marketing is deeply embedded in our daily lives as we spend most of our online. Organisations have extensively started using digital mediums for their marketing campaigns.

More here: https://goo.gl/vNBGEp

Companies use various platforms like search engines, social media, emails, online shopping websites to connect with current as well as prospective customers for their marketing campaigns.

The banking industry is booming the implementation of digital technologies, perhaps more than any other sector, to enhance its business processes. And this entanglement of technology and industry continues with the introduction of cognitive technology. Cognitive technology is a new avenue for cost control through cognitive tooling and automation with distinctive optimization possibilities.

Cognitive technology generally relates to systems that use Artificial intelligence and signal processing to imitate logical human potential. These self-learning systems use a range of information, predictive analytics, and natural language processing. Cognitive technology makes banking and financing more productive while also providing an excellent customer experience by assisting in the following ways....Follow above link to know more

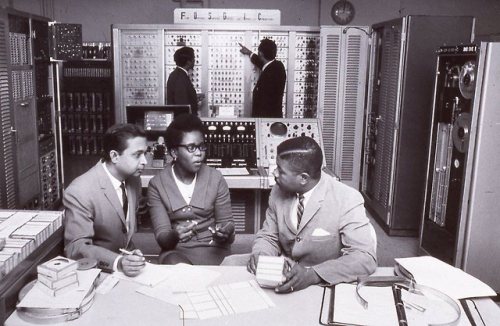

U.S. Census Bureau employees, circa 1960s, with the Film Optical Sensing Device for Input to Computers (FOSDIC), a device used to transfer data from paper questionnaires to microfilm.

Introducing Top 3 Startups Ready to Take on Banking Analytics

Success of any business decision depends on the quality and quantity of information. Some firms have access to more information than others; particularly good examples could be banks.

The banking industry is subject to a wide array of stringent regulations that govern their daily operations. Remaining compliant with this environment requires banking institutions to memorize nearly all aspects of their actions, including conversations, transactions, and customer transcripts.

In short, banks produce reams of raw data daily, most of which are to be scarcely analyzed or reviewed. Data analytics is a powerful solution that enables banks to take advantage of the raw data by transforming it into highly useful analytical forecasts.

Like diamond amidst coal, raw data includes valuable information that is left undiscovered as its extraction is often burdensome and expensive. This has created an opportunity for entrants to help banks make complete sense of data and comply with the increasing regulations in a cost-efficient manner. Here is a glance on the three of the hottest banking analytics solution startups catching the attention of leading players in the industry.

• Hexanika

Hexanika is a forerunning data management and reporting solution provider for financial institutions. It uses artificial intelligence, big data, and robotics to automate the process of data management. Its solutions aid financial firms to tackle the rapid challenge posed by regulatory pressures and increasing global competition while reducing cost and time of the processes. Founded in the U.S., its innovative solutions improve data quality and keep regulatory reporting in harmony.

Hexanika’s unique big data deployment approach simplifies, optimizes, and reduces the cost of banking analytics. To streamline data, it offers end to end data management, analytics, and reporting platform making banking analytics effective. The company is providing its solutions to financial institutions and helping them keep pace with changing regulatory requirements by leveraging artificial intelligence.

• Flybits

Banks are looking for ways to maximize their use of data and better engage customers. The contextual data intelligence company, Flybits leverages the Read More

Fintech

Banking

Data Solutions

-

sugrtroy liked this · 3 years ago

sugrtroy liked this · 3 years ago -

catocorps liked this · 4 years ago

catocorps liked this · 4 years ago -

roosinii liked this · 4 years ago

roosinii liked this · 4 years ago -

sea-emenemeny liked this · 4 years ago

sea-emenemeny liked this · 4 years ago -

animeeaglescout liked this · 5 years ago

animeeaglescout liked this · 5 years ago -

spookytragedylover-blog reblogged this · 5 years ago

spookytragedylover-blog reblogged this · 5 years ago -

leadingedgedeals2-blog reblogged this · 5 years ago

leadingedgedeals2-blog reblogged this · 5 years ago -

leadingedgedeals2-blog liked this · 5 years ago

leadingedgedeals2-blog liked this · 5 years ago -

peachesannndgravy reblogged this · 6 years ago

peachesannndgravy reblogged this · 6 years ago -

jelly-nim-blog liked this · 6 years ago

jelly-nim-blog liked this · 6 years ago -

ebony-eldritch-chocolate reblogged this · 6 years ago

ebony-eldritch-chocolate reblogged this · 6 years ago -

devoid-of-chaos reblogged this · 6 years ago

devoid-of-chaos reblogged this · 6 years ago -

devoid-of-chaos liked this · 6 years ago

devoid-of-chaos liked this · 6 years ago -

atxempirecom reblogged this · 6 years ago

atxempirecom reblogged this · 6 years ago -

techinfinity reblogged this · 6 years ago

techinfinity reblogged this · 6 years ago -

chaosviatge-blog liked this · 6 years ago

chaosviatge-blog liked this · 6 years ago -

juniperous-blog1 liked this · 6 years ago

juniperous-blog1 liked this · 6 years ago -

computerlandstuff-blog liked this · 6 years ago

computerlandstuff-blog liked this · 6 years ago -

techinfinity reblogged this · 6 years ago

techinfinity reblogged this · 6 years ago -

celestial-perdition reblogged this · 6 years ago

celestial-perdition reblogged this · 6 years ago -

celestial-perdition liked this · 6 years ago

celestial-perdition liked this · 6 years ago -

lookingformeaningxx liked this · 6 years ago

lookingformeaningxx liked this · 6 years ago -

screechingphantomfestival-blog liked this · 6 years ago

screechingphantomfestival-blog liked this · 6 years ago -

oscarmike reblogged this · 6 years ago

oscarmike reblogged this · 6 years ago -

oscarmike liked this · 6 years ago

oscarmike liked this · 6 years ago -

kouhwai liked this · 6 years ago

kouhwai liked this · 6 years ago -

ferboby liked this · 6 years ago

ferboby liked this · 6 years ago -

moonlitegay liked this · 6 years ago

moonlitegay liked this · 6 years ago -

z765ccc liked this · 6 years ago

z765ccc liked this · 6 years ago -

dunloth liked this · 6 years ago

dunloth liked this · 6 years ago

Your Daily dose of Latest Technology Updates, news, articles across various Industry Sectors

267 posts